The standard corporate income tax rate in Malaysia is 24. Expenses for a gulfstream iv and a beechcraft king air 350.

29th October 2021 - 1 min read.

. Generally an expenditure is not tax deductible if. 19 rows Additional deduction of MYR 1000 for YA 2020 to 2023 increased maximum to MYR 3000. List Of Tax Deduction For Businesses.

Travelling allowance petrol allowance toll rate up to. Parking Fee Allowance Limit to reasonable amount Official Travelling. Not wholly and exclusively incurred for the purpose of business eg.

The total cost incurred is RM60000 comprising cost of travel fares amounting to RM40000 and cost of meals and accommodation amounting to RM20000. However there are exemptions. This is not tax deductible for the wiring expenses such as installation of new machine.

Medical expenses for serious diseases for self spouse or child. Malaysian who travels domestically in 2020 will be eligible to receive RM100 worth of digital voucher per person. The standard corporate income tax rate in Malaysia is 24.

How To Redeem RM100 Digital Voucher For Local Travel. Complete medical examination for self. Charged to income tax under paragraph 131b of the Act.

Just like Benefits-in-Kind Perquisites are taxable from employment income. Resident company with a paid-up capital of RM 25. 14 Income remitted from outside Malaysia.

If you use taxis or public transport to get to your accommodation or to your work location this is deductible. For an expense to qualify for a tax deduction it must be i incurred in the production of the income. Personal Income Tax Relief up to RM1000 for domestic travel expenses.

Wiring expenses under repair purpose is allowed for tax deduction. Medical expenses for fertility treatment for self or spouse. Finance Minister Tengku Zafrul Aziz has announced that under Budget 2022 the government will extend the special individual income.

Employee Benefits That are Tax Deductible Employers Tax Exempted Employees. 19 rows Additional deduction of MYR 1000 for YA 2021 increased maximum to MYR 3000. Declaranet descargar Denuncia Electrónica Anónima.

Five Common Questions To Ask Yourself About Tax Deductible Expenses Standard Deduction 2020 2021 What It Is And How It Affects Your Taxes Wsj Related. Meriah Sdn Bhd is. Special relief for domestic travelling expenses until YA.

The personal income tax relief of up to rm1000 for domestic tourism expenses will inject life into the sector but industry players are hoping for this to be. And 73 the treatment of leave passage expenditure whether within or outside Malaysia incurred by the employer for the. Private expense Pre-commencement expenditure.

Travel when at your destination is also tax-deductible. The claim period for income tax relief. In late February this year it was announced under the 2020 Economic Stimulus Package that Malaysians who.

Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and. Other corporate tax rates include the following.

13 Tips For Making Your Charitable Donation Tax Deductible In 2017

Pemerkasa Assistance Package Crowe Malaysia Plt

200 Tax Deduction In Thailand For Investment In Automation System Income Tax Thailand

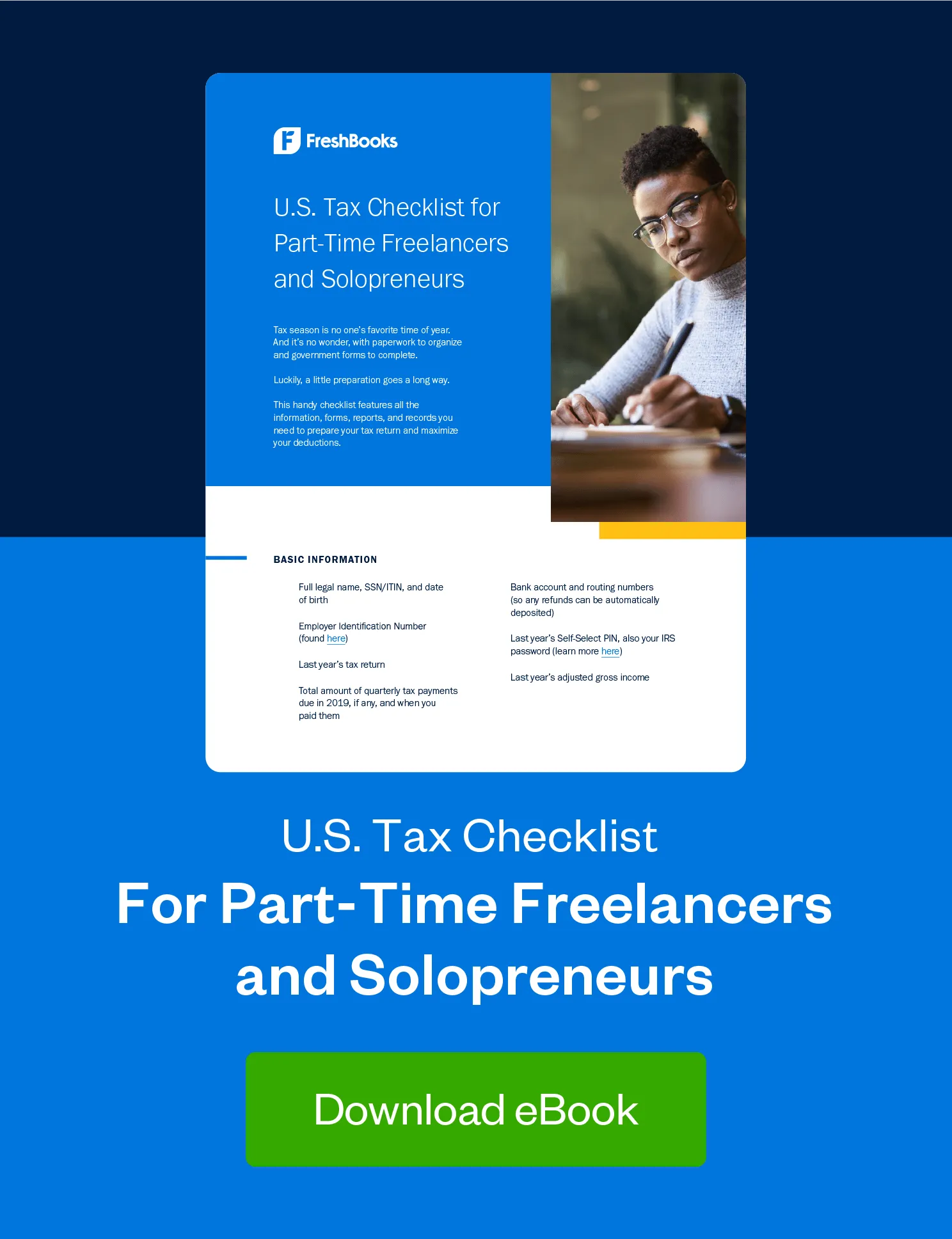

Tax Write Offs For Freelancers Freshbooks Blog

Foreign Rental Income How To Report It On Overseas Property

Tax Legal News Flash Issue 66 Kpmg Cayman Islands

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

Key Takeaways Of Malaysia Budget 2021

How To Do Payroll In Excel In 7 Steps Free Template

Tax Write Offs For Freelancers Freshbooks Blog

13 Tips For Making Your Charitable Donation Tax Deductible In 2017

Section B All Six Questions Are Compulsory And Must Chegg Com

Travel Claim Personal Income Tax Relief Travel Expenses Malaysia Offers In 2022 Berjaya Hotels And Resorts Official Website

Ogmr Accounts Tax Payroll Home Facebook

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

- video permainan ulang tahun

- cara khatam al quran sendiri

- simptom hiv pada lelaki

- vans malaysia buy online

- khidmat masyarakat in english

- undefined

- travelling expenses tax deductible malaysia

- converse jack purcell malaysia

- contoh hiasan plafon kelas

- resepi pengat labu jagung

- mercedes glc body kit malaysia

- pintu kebaya modern

- umrah tanpa mahram 2019

- promosi tiket air asia 2018

- tugu negara kuala lumpur

- bawal batu swarovski

- logo design malaysia online

- boring arti bahasa inggrisnya

- pepatah arab tentang masa

- warna oranye dalam islam